How to order

Read this article to get help on ordering so your purchase wont get stuck during checkout.

How to order products from Eu.Tramigo.Store

Shipping and taxes

Eu.Tramigo.Store delivers product globally. All shipping and taxes will be calculated at check out. Shipping costs are calculated based on weight. and destination We will continue the development of available shipping and payment options provided.

All orders of 300€ and more are eligible for free shipping.

All shipments will be made using only shipping methods that provide you and us with a tracking code that allows both parties to monitor shipment progress.

VAT excemptions for EU based businesses.

VAT in Finland is 24% on total cost. In accordance to EU tax regulations, all EU businesses are excempt from paying VAT. In order to qualify for VAT exception businesses register their business using a valid EU VAT code during check out. (VAT codes will be checked before shipments are sent and we will contact you incase you have accidentally entered invalid code.)

Please view instructions below to learn how to register your business during check out. returning customers who have previously registered their businesses will be able to login and VAT excemption will be automatically applied.

Guide:

Registering your business for VAT exception during check out

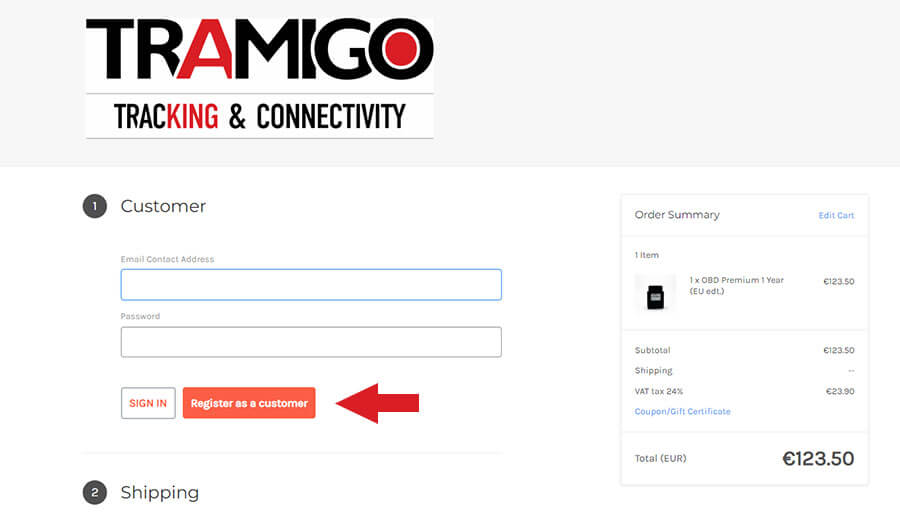

Step 1

If you are a first time customer, start by registering as a new customer.

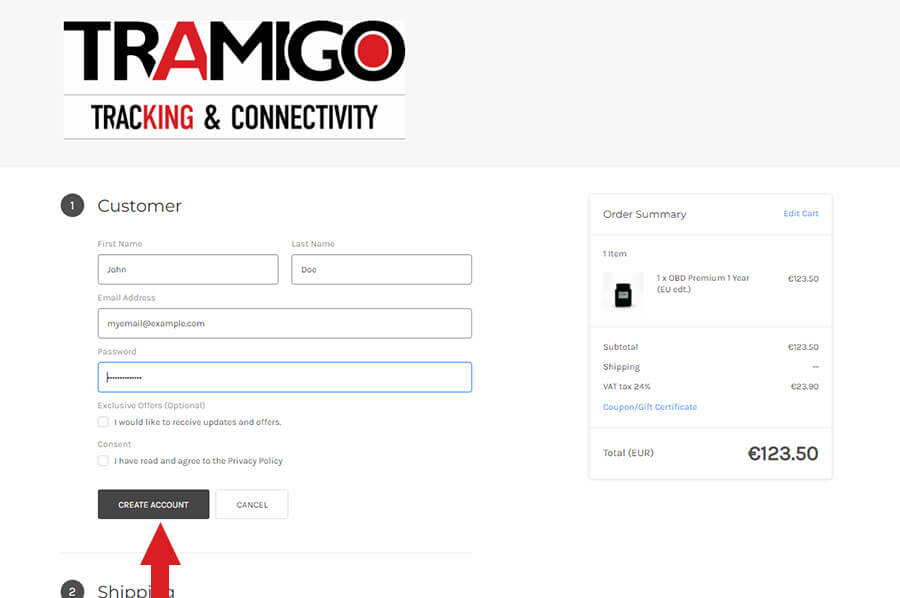

Step 2

In the first step of the registration process you will be asked for the details required to create an account.

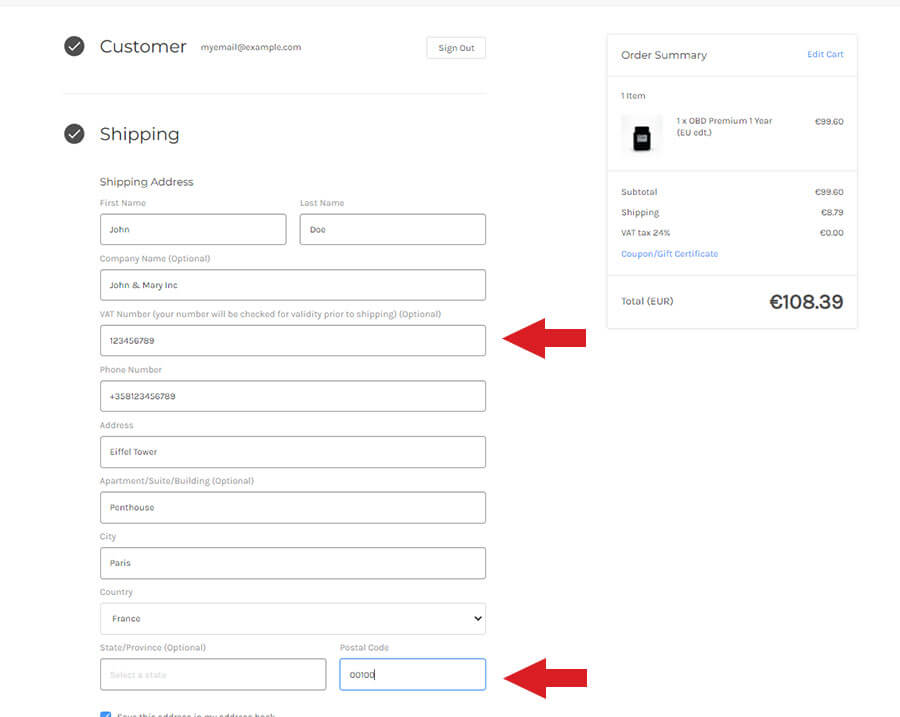

Step 3

After you have created a new account it is time to enter the shipping details. Your shipping fees are alculated automatically based on your shipping address. EU based businesses will be excempt from having to pay the VAT. So please make sure you enter your VAT number correctly in the appropriate field. (Our staff will contact you before shipping if there is a mistake in the VAT number you have entered).

Once you have completed the rest of the details and enter the postal code, yor shopping cart price will now show your actual shipping costs. For those who added their busines VAT number , the VAT will be automatically reduced from the total amount due.

You will now be able to proced to payment complete payment.

Upon completing payment our system will emailyou a confirmation, your invoice and once the product is shipped your Tracking code.